Our Value

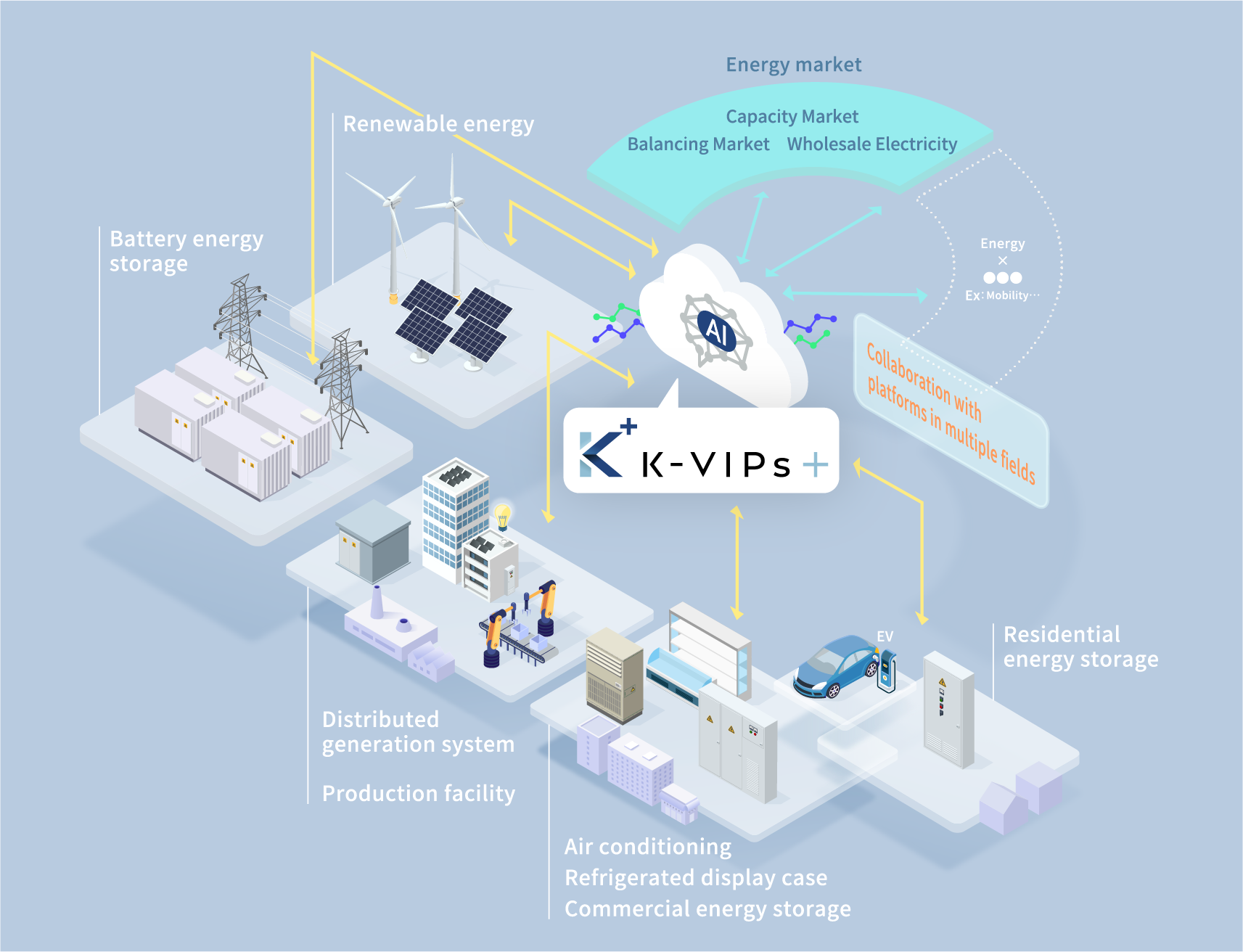

Distributed Service Platform equipped with AI.

Points of K-VIPs+

Point01

Through the operation and transaction agency of various facilities such as grid-scale energy storage systems and renewable energy sources, we can maximize the value beyond demand-side resources.

Point02

By leveraging our proprietary AI algorithms, we accurately predict market trends and achieve optimal transactions.

01

The features of K-VIPs+ are as follows

For a more prosperous society.

A new endeavor that maximizes the utilization

of aggregation capabilities.

K-VIPs+ is a distributed service platform equipped with a newly developed proprietary AI algorithm.

It centrally manages a diverse range of distributed energy resources nationwide and engages in transactions selecting optimal markets such as capacity markets, demand-supply adjustment markets, and wholesale power markets, to generate electricity value (kW, kWh, ΔkW).

Furthermore, K-VIPs+ aims to enhance its capabilities by advancing market forecasting systems and leveraging data obtained through the operation of various resources. It also collaborates with information platforms in promising sectors of daily life and industry to contribute to the creation of new services and the resolution of societal challenges.

02

A new world that "K-VIPs+" is pioneering

Expansion of VPP resources

In addition to the industrial and commercial VPP resources we are currently collaborating with, we aim to utilize various devices surrounding daily life, such as storage batteries, air conditioners, water heaters, EVs, etc., as VPP resources. We will work in collaboration with various resource aggregators (※).

For the integration between the resource aggregators' servers and K-VIPs, we will utilize widely-used technologies such as OpenADR and WebAPI to achieve faster and more extensive collaboration with a larger number of resources.

(※)Resource aggregator: A service provider that directly contracts with end-users for VPP services and performs resource control.

Maximization of VPP resource value

K-VIPs+ will be developed as a system that can adapt to capacity markets, demand response markets, wholesale electricity markets, and other upcoming electricity markets. In addition to utilization in these markets, we aim to provide various services for trading the electric value generated from diverse distributed energy resources. Together with resource aggregators and resource providers, we strive to create new value.

Collaboration with platforms in multiple fields

K-VIPs+ aims to become a platform that can be utilized for a wide range of business domains beyond the energy sector by collaborating with platforms in various fields, including emerging fields such as mobility.

Furthermore, we will contribute to addressing societal and environmental challenges, such as improving energy efficiency, expanding renewable energy, and enhancing resilience in emergencies, not only by creating innovative fusion services that have not existed before but also by leveraging the K-VIPs+ platform.

【Examples of collaboration with mobility include】

By combining with the field of mobility, we can predict and control human flow to eliminate fluctuations in power consumption.

Additionally, we can utilize EV as DR resources to stabilize regional power supply and demand. These collaborations have the potential to reduce equipment investment costs in both fields and offer broader applications.

E-Flow utilizes "K-VIPs+" to optimize operations by calculating transaction time and volume in electricity markets, taking into account the characteristics of the electricity value entrusted by customers nationwide.

About Electricity market

What is the Capacity Market?

The capacity market is a market where "future capacity (kW)" is traded, rather than the "electricity quantity (kWh)" traded in the traditional wholesale electricity market. It was introduced widely in the 2020 fiscal year in many countries to efficently secure the necessary supply capacity for the future. And was established in the fiscal year 2020. Specifically, it is a mechanism to ensure long-term investment recovery predictability for supply capacity such as power plants, and to promote appropriate power source construction based on market principles to secure the necessary supply capacity in the medium to long term.

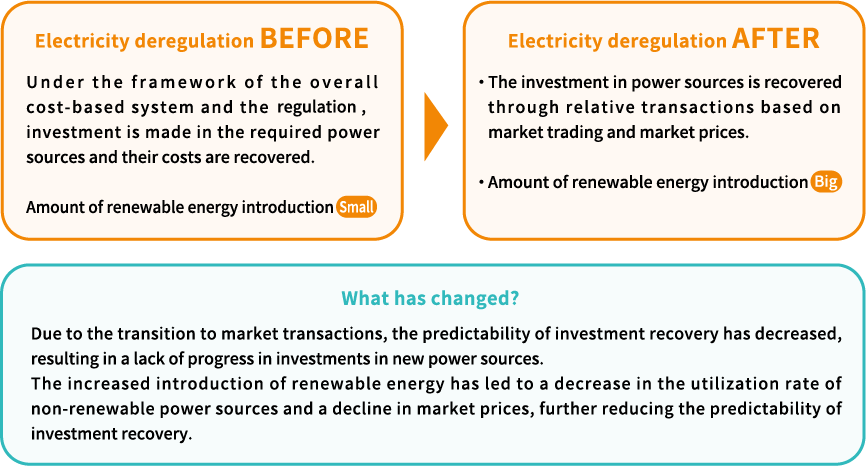

Background for the establishment

of the capacity market

The environment surrounding power companies has undergone significant changes due to the liberalization of the electricity market and the introduction of the feed-in tariff (FIT) system, which has led to the expansion of renewable energy. However, in order to maintain a stable power supply, it is still necessary to have a diverse range of power sources (power plants) and stabilize the supply capacity.

To construct or replace power sources, a significant amount of time is required, and without a clear outlook, it becomes challenging for businesses to proceed with such projects. If this situation is left unaddressed, investments in power sources may not be made appropriately, leading to compromised stability of power supply and the potential for increased electricity prices.

Therefore,

① To ensure the reliable procurement of the required supply capacity in advance.

② By achieving the stabilization of electricity market prices, it brings benefits to all customers using electricity.

The capacity market was established with the aim of achieving the stabilization of electricity market prices and bringing benefits to all customers using electricity.

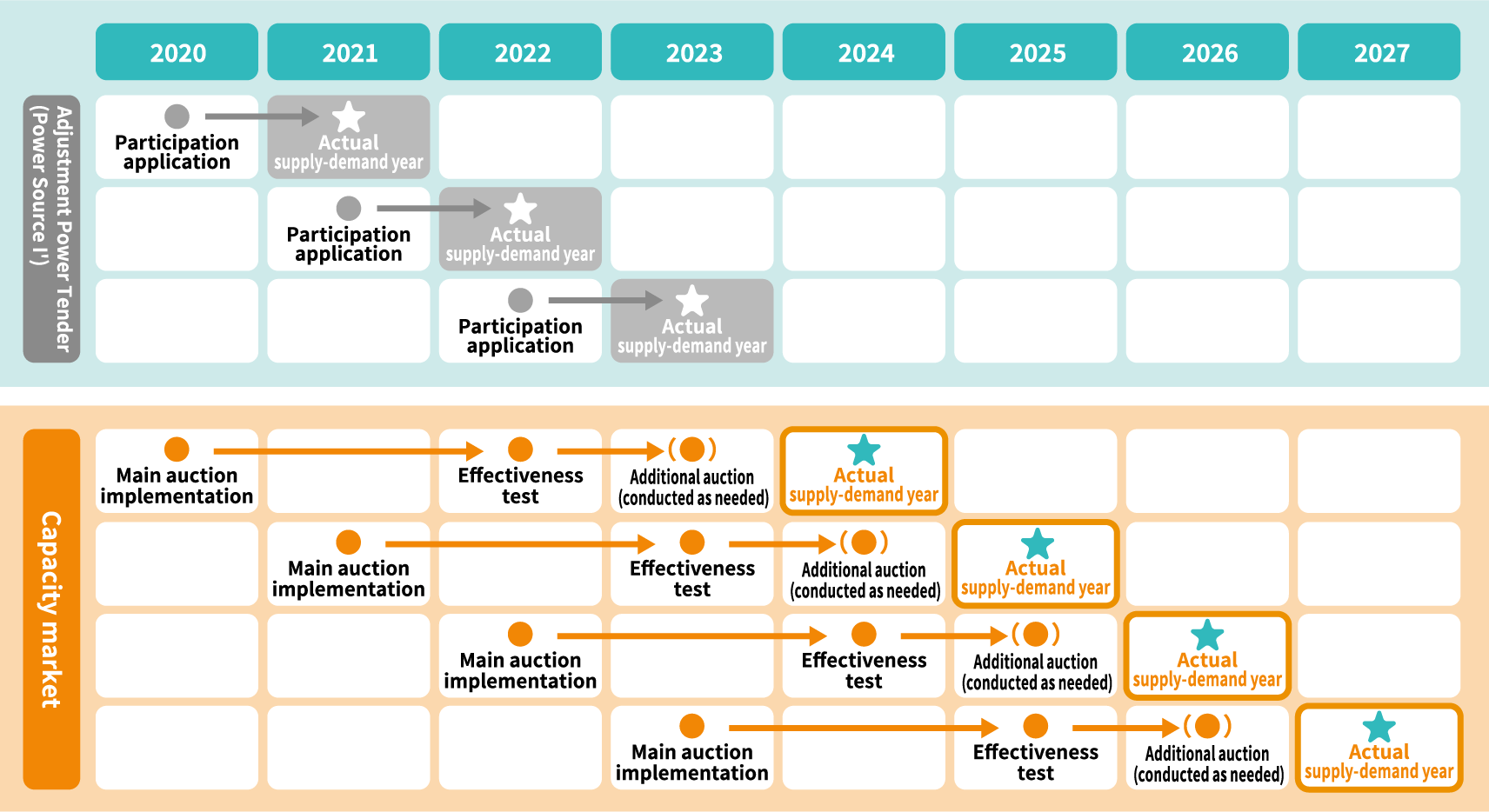

The overall schedule of the capacity market

For customers participating in the Capacity Procurement and Adjustment (CPA) for Reserve (Power Source I'), they can also participate in the capacity market in a similar manner. Customers participating through demand response can receive rewards through CPA until the end of the fiscal year 2023, and starting from the fiscal year 2024, they can receive rewards through participation in the capacity market. The CPA typically accepts applications for the following fiscal year in the previous year. However, for the capacity market, the main auction is conducted four years in advance and the effectiveness test for power sources is conducted two years in advance, aiming to ensure long-term predictability. Therefore, it is necessary to reach an agreement with customers and facilitate their participation in the capacity market at an early stage compared to the CPA.

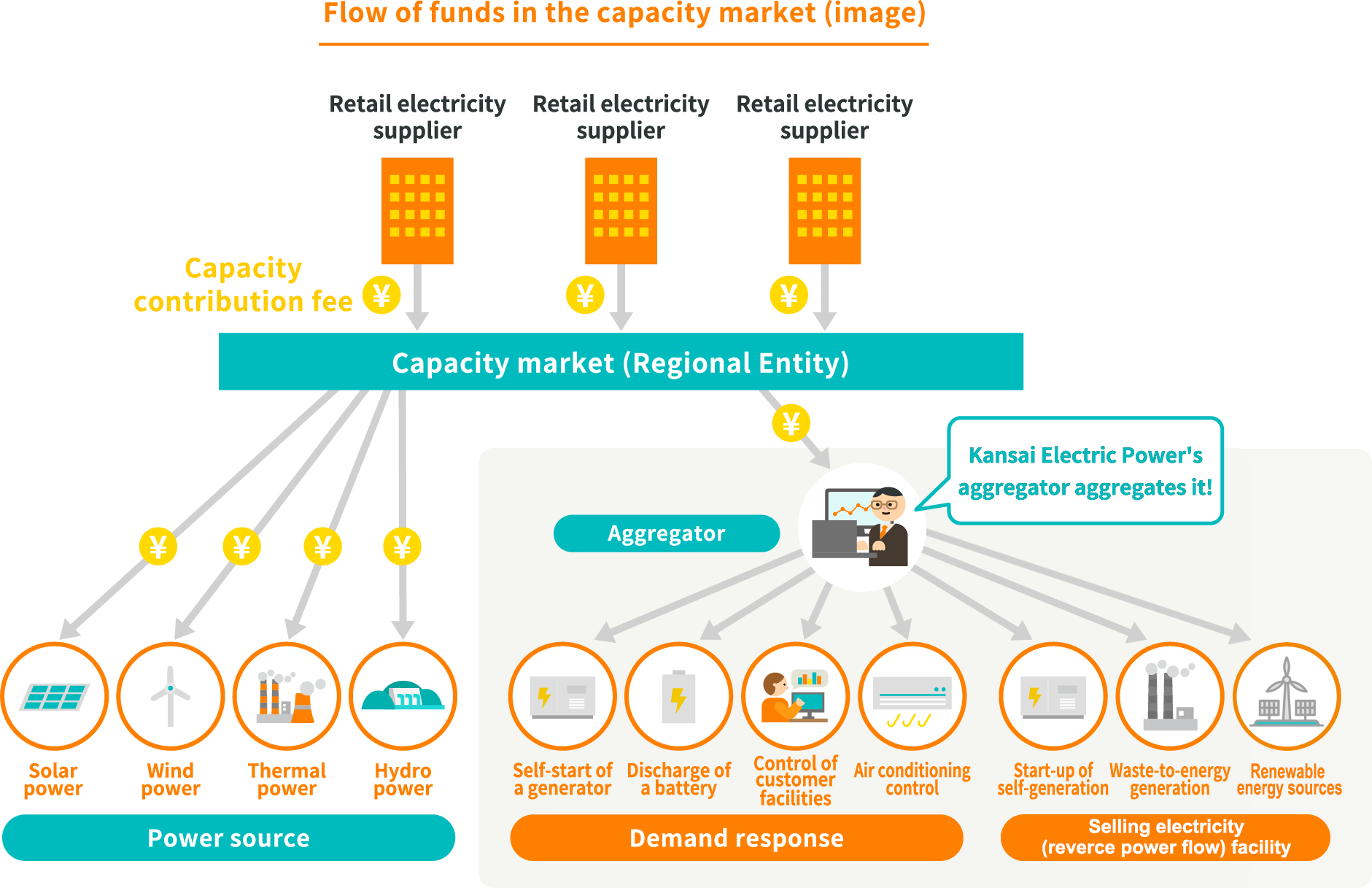

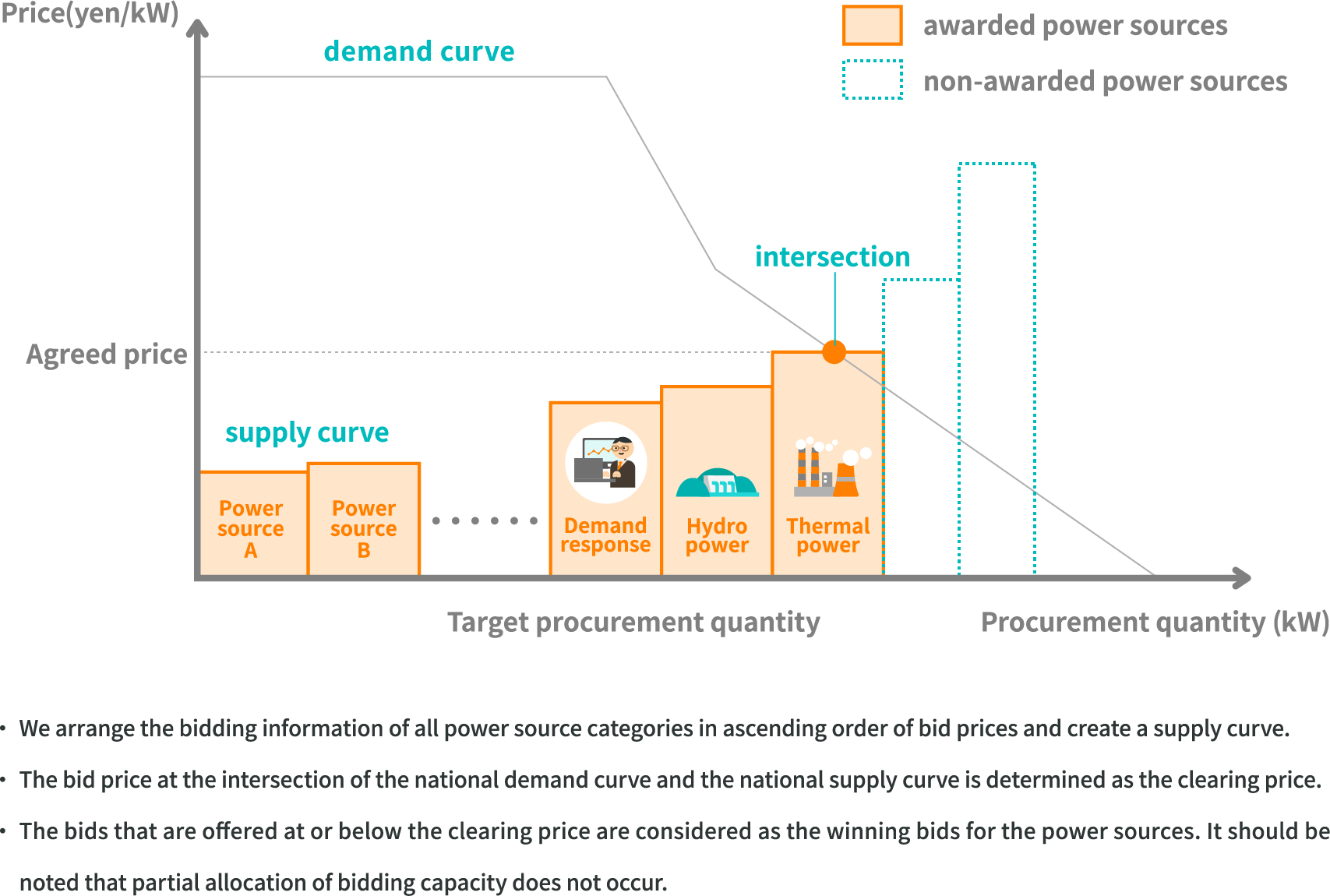

The mechanism of the capacity market

The capacity market is a system where the Electricity Market Surveillance Commission (EMSC) secures the required capacity nationwide through a centralized bidding process, four years before the actual demand-supply year.

Capacity market clearing price

The clearing price is determined using a single-price mechanism, where the agreed price is generally set as the highest bid price among the successfully bid power sources.

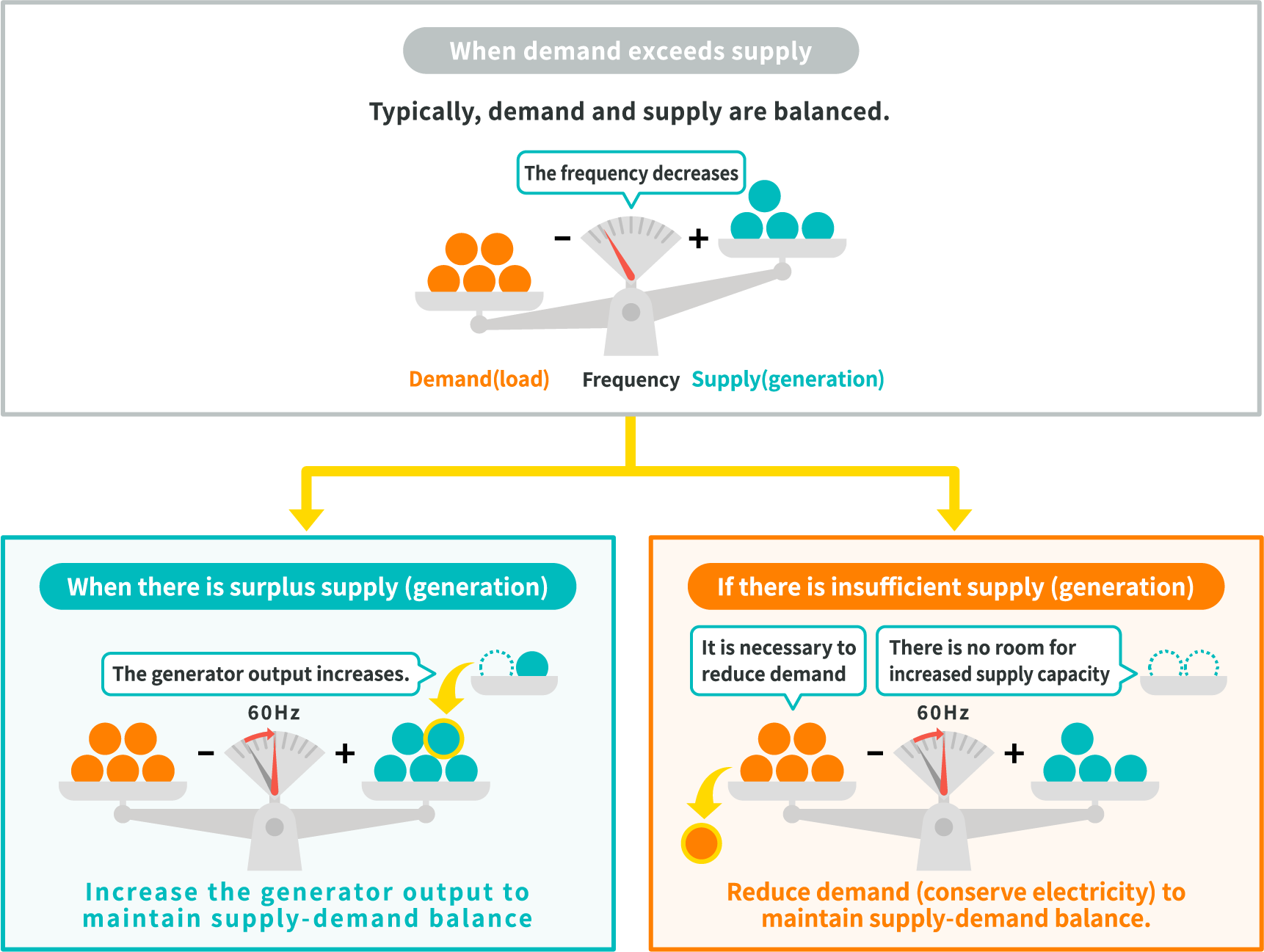

What is the Balancing Market?

The Demand-Supply Adjustment Market is a market where "adjustment capacity (ΔkW)" is traded. In order to prevent power outages and disruptions to equipment, it is necessary to always match the electricity supply with demand. The power required to match demand and supply at power plants and other facilities in response to demand fluctuations is referred to as "adjustment capacity". Regional Transmission System Operators (TSO) play a role in ensuring stable supply by utilizing this "adjustment capacity".

Establishment of the supply-demand

adjustment market

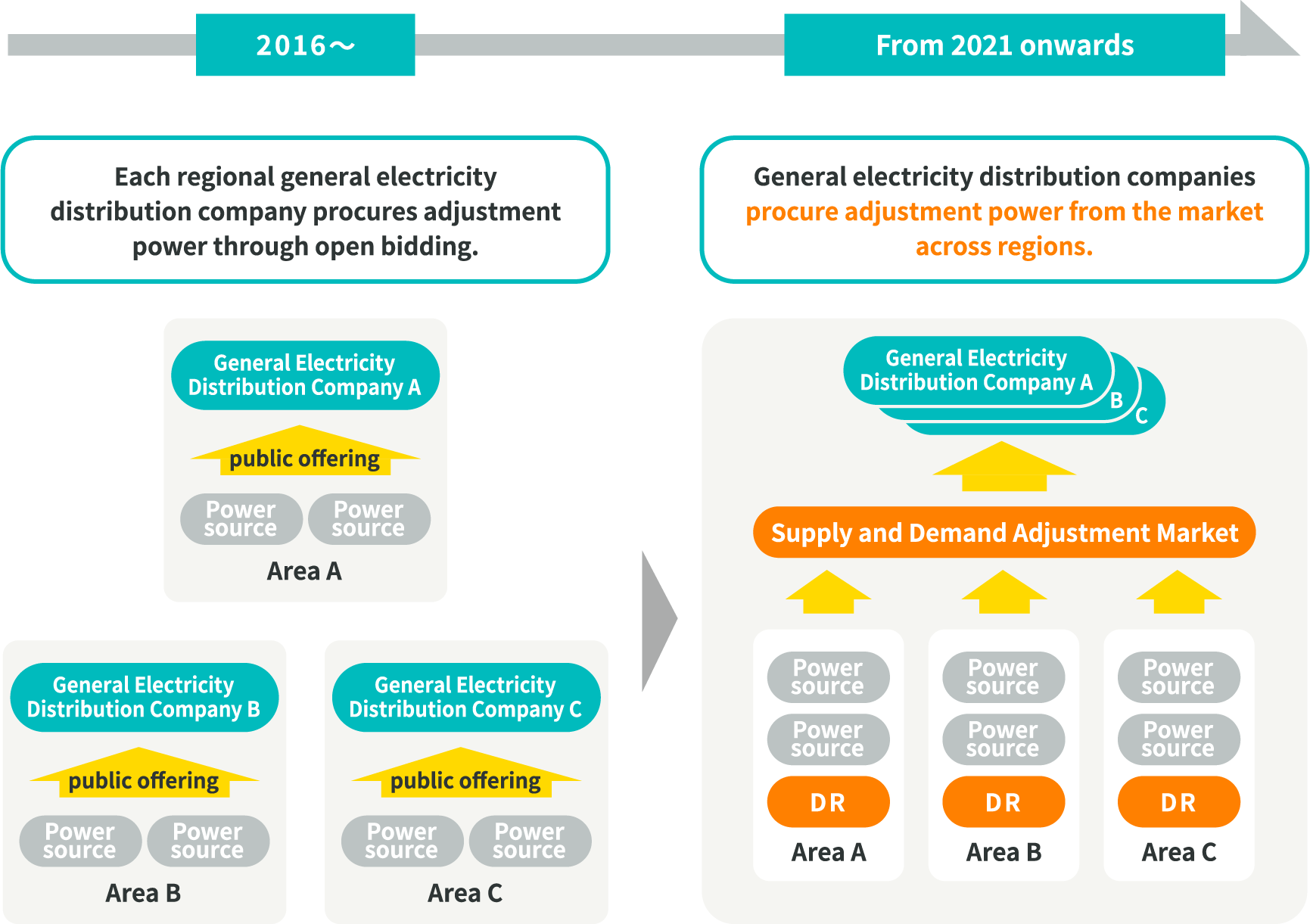

With the introduction of the license system in April 2016, each TSO has been procuring adjustment capacity through public bidding (adjustment capacity solicitation).

From April 2021, a system called the "supply-demand adjustment market" will be implemented, allowing the trading of this adjustment capacity in a nationwide integrated market. By enabling various businesses to participate in a single market, price competition is expected to be promoted, leading to cost reduction in securing adjustment capacity.

Additionally, in the supply-demand adjustment market, product categories are provided for trading demand response (DR) utilizing customers' energy resources on the demand side.

Products traded in the Electric Balancing Market

There are five main product categories traded in the Electric Balancing Market, starting from April 2021, the trading of the slowest tertiary adjustment power ② has begun. It is planned to gradually expand the products to faster response categories in the future.

Here is the status of the examination of the Supply and Demand Adjustment Market system

(TDGC(Transmission & Distribution Grid Council)HP) ▼

What is the

Japan Electric Power Exchange (JEPX) market?

The JEPX market is a market where "electricity quantity (kWh)" is traded. It was established in 2003 in response to the liberalization of the electricity market and facilitates the daily trading of electricity quantity divided into 48 individual products based on the measurement unit of electricity for each half-hour period of the day.

The wholesale electricity market mainly consists of the "spot market (a day-ahead market)" and the "Intraday market (real-time market)" among others.

Depending on the market, the products, trading periods, and methods of determining the agreed prices vary. The minimum trading unit is 50 kWh per trading interval, which corresponds to one trading block (30 minutes).

Spot market (A day-ahead market)

- The spot market is a market where electricity to be generated or sold the next day is bid and traded by 10:00 a.m. on the previous day, and bidders select bidding intervals from the 48 intervals in a day.

- The price is determined through a method called 'single price auction,' where the price is traded at the contracted price regardless of the bid price.

- The spot market fluctuates daily based on the electricity demand and supply situation, as well as seasonal factors, leading to changes in market prices.

The Intraday market

(also known as the intraday market)

- The intraday market is a platform for trading electricity that facilitates adjustments in generation and demand resulting from generation issues or changes in temperature, which occur after the day-ahead planning has been conducted.

- While the spot market calculates the entire day into 48 intervals, In the intraday market, trading is conducted in 30-minute intervals for each product, based on time priority and price priority.